How is the Coronavirus impacting the Global economy?

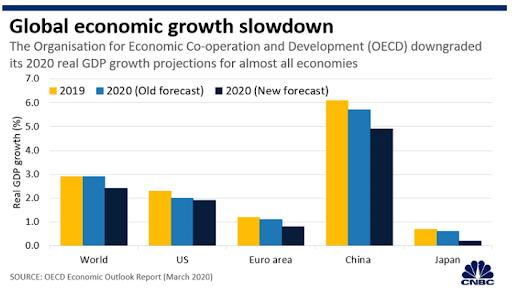

The rapid spread of coronavirus has become a severe threat in the global economy plus financial primary markets. After largely ignoring the Covid-19 as it spread across China, now in recent times, the global financial market was affected when the virus was spread in Europe plus the middle east. Now it has taken the shape of a global epidemic. After that, the risks of Covid-19 have been labeled with a price very rapidly by the asset class, that now there is a constant fear of witnessing a global recession in the economy. The virus was first discovered in a city of China of Wuhan in December 2019 which has grossly tainted more than 105,000 people in at least 100 countries plus districts across the universe as per the to the measure executed by world health organization. It has been reported that there have been more than 3500 deaths as per the to the stimulation projected by the World Health Organization. China has borne most of the damage where the confirmed attacks were found. There have been more than 75000 infections which were witnessed by the mainland of China. In order to resist the attack plus outbreak of Covid-19 the Chinese authorities have locked down the major places, suspended the movements plus paused the business operations. It will definitely decline the growth of the world’s one of the largest economies plus will eventually bring a diminution in the universal economy. The virus is quickly disseminating in various countries Italy, Iran, Korea where they have reported a found case of more than 6000. On the other hand, the countries of Europe like Germany, France, plus Spain have recently reported a growth of that like more than in 800 of cases. As per the statement of the global research head of Oxford Economics, the prior problem from an economical standpoint is not the case numbers of Covid-19, rather than the disruption found in thriftiness for the containment enactment. He further stated that the measures beheld by China are needed to be properly adequate plus proportionate to hold down the panic which can, later on, affect the global economy even higher. The stock prices, bonds plus the financial market has been largely affected by the Coronavirus outbreak. Below mentioned are some of the instance of the impact which Covod-19 has created upon the global economy. Like the Economic co-operation plus development organization, many other reputed institutions, banks plus financial firms had to downslope their forecasts for the global economy. As per the report presented by OECD, it has been clearly mentioned there that it has down-sloped the growth plus extension prospect for the year 2020 in almost all leading economies of the world. The GDP growth rate of China witnessed a massive breakdown plus diminution in terms of magnitude plus extension. The Asian economy is supposed to grow at a rate of more than 4.5% this year which is definitely slower than the earlier forecast which was near about 5.5%. The global economic growth rate has been considerably less which is supposed to grow by less than 2.6%. It is also lesser than the projection which was made earlier of around 3.1%.Down-sloping economic estimation –

Share your project details to build your path toward success.

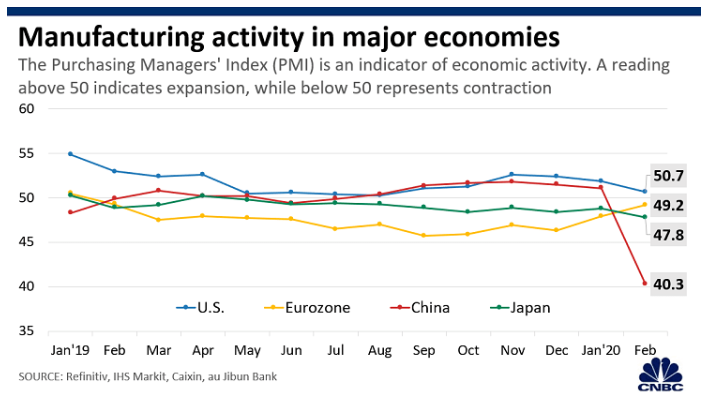

Manufacturing downslope –

The manufacturing sector of China has witnessed a great recluse due to the virus outbreak. According to a survey conducted by private organizations namely The Markit Manufacturing Purchasing Manager’s Index China faced a contraction in their factory growth plus expansion in the month of February. The record low reading was even lesser than 41.2 which definitely approves the contraction.

The countries which have a close economic connection to that of China has been pretty severely damaged to these virus outbreaks. Those were respectively Asian Pacific economies. The countries were namely Singapore, Korea plus Vietnam.

There is not much sign of resuming the operation in plus around of China thus the specialists opined that the global manufacturing activities will remain inhibited for a longer period of time.

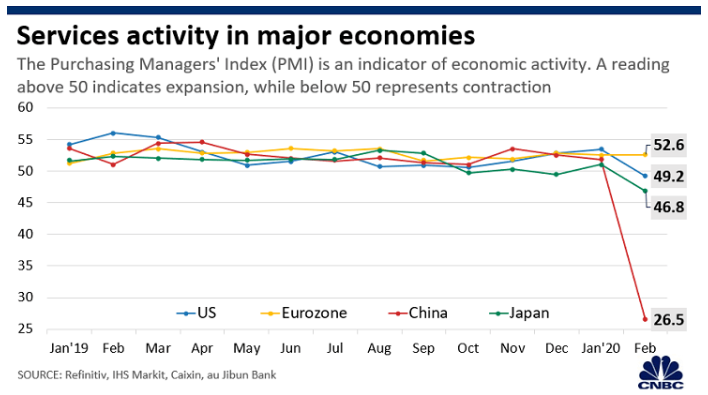

Service Compression –

The service industry of China has also been severely affected by the virus outbreak. Mainly the troubles are being faced by the restaurants, retail stores plus the aviation sector.

The special denomination mark, The Markit PMI for China faced an algorithm of less than 27. It was the first drop from 50 points in the last 15 years. As per the IHS Markit, the service sectors of the world's largest consumer market have also declined like that of China. The primary reason behind the service contraction of the United States was mainly due to the global customers being afraid to place orders in universal economic uncertainty plus this major break of coronavirus. It was stated duly by IHS Markit.

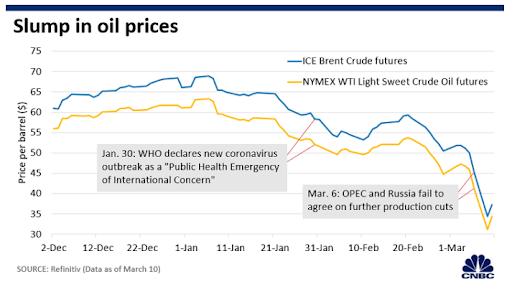

Down-slope in oil prices –

The diminution in the global economy has caused to seize as well as reduce the demand for oil which has brought the oil price into a very much low region. There was a disagreement in the surplus production cost cuts between OPEC plus its co-partners which has seemed to be caused the drop-down in the price of the oil.

However, the extreme reduction of oil demand along with the excessive supply of oil which has recently accelerated caused the oil markets to become vulnerable. However, China as the central point of coronavirus spread out is, unfortunately, the largest importer of crude oil.

However, from a recent survey, it has been reported that the outbreak of the virus in the European countries will definitely be a major cause of the contraction in OECD countries.

Stock Market Recluse –

The stock prices have been diminished in various primary markets as the virus dissemination has seriously caused trouble for the investors to invest money in Asian markets. The country risk plus global strategic head of Fitch solutions have found our three channels as well as three ways to work the way through sentiments of markets.

The three channels have been recognized as the slowdown of China, domestic collapse plus the financial market tension.

Bond Concession –

Due to the sudden break of Coronavirus the investors have bid higher in the bond prices that is why there has been a concession in the major economies towards a lower grade. The American financial market is considered a safe asset where the investors have come across during the time of vulnerability.

The U.S treasury contracts have fallen below by less than 1.5% in February. The benchmark of a near about 9 years' contract has faced the historical downgrade of even lesser than 0.4%.

The federal reserve has cut down the interest rates. As the U.S central bank has made a production cut on haste that has actually turned down the rate of target fund by lower than 1.5%.